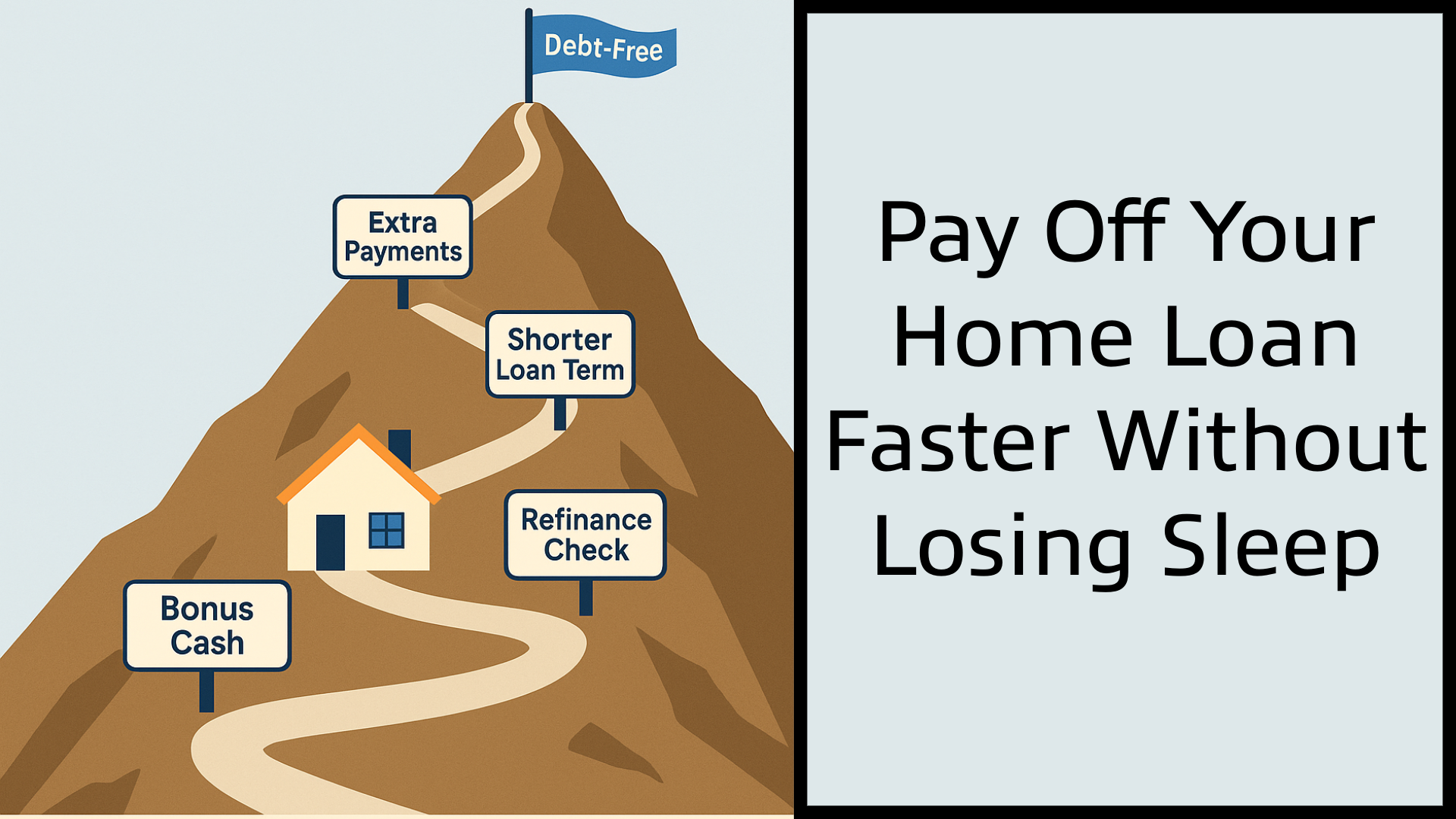

Pay Off Your Home Loan Faster Without Losing Sleep

Paying off a home loan can feel like climbing a huge mountain. It takes years, and sometimes it feels like you're not getting anywhere. But there are some simple tricks that can help you finish the climb faster and feel more in control of your money.

Start with a Little Extra

If you can pay a little more than your regular monthly payment, even just once in a while, it can make a big difference. Adding a little extra each month lowers how much you owe and can save you a lot in interest over time. Think of it like chipping away at that mountain one small rock at a time.

Pick a Shorter Plan

When you choose how long to pay off your loan, shorter is better if you can afford it. A 15-year loan means higher payments each month, but you’ll finish faster and pay much less interest than a 30-year one. It’s like taking a faster trail to the top of the mountain.

Use Bonus Money Wisely

Did you get a holiday bonus, tax refund, or some surprise cash? Instead of spending it all, use some of it to pay off your loan. It’s like jumping ahead a few steps on your journey.

Look at Your Loan Again

Sometimes it helps to check if you can switch your loan for a better one. Maybe interest rates have dropped, or maybe you qualify for a better deal now. Just be sure to check for any fees or rules before making a change.

Stay on Track and Review Often

Make a habit of checking how much you still owe. Watching your progress can keep you motivated. It’s also a good idea to review your loan once a year to see if there’s anything you can do to speed things up.

Why This Matters

When you pay off your loan sooner, you free up money for other goals—like starting a business, going on trips, or saving for the future. You also get peace of mind knowing your home is fully yours.

One financial expert once said that taking charge of your debt isn’t about making huge sacrifices. It’s about making small, smart choices again and again. That’s advice anyone can follow.